Among the latest additions to the Cash Management.iQ software family are “ATM Bags”, “ATM Cassettes”, and the option of monitoring cash advances provided to cashiers.

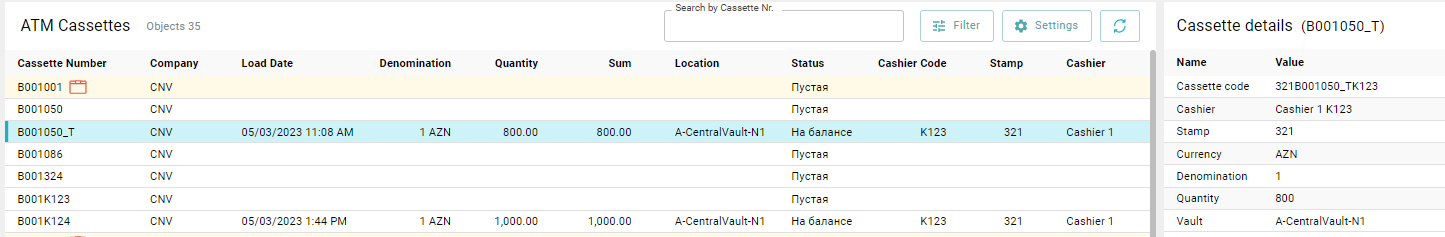

The “ATM Cassettes” functionality records the loaded cash cassettes used by cash-in-transit services.

Displayed information includes:

- Loaded amount considering the denomination

- Number of filled cassettes

- Date of filling and cassette number

- Seal number

- Cashier’s name

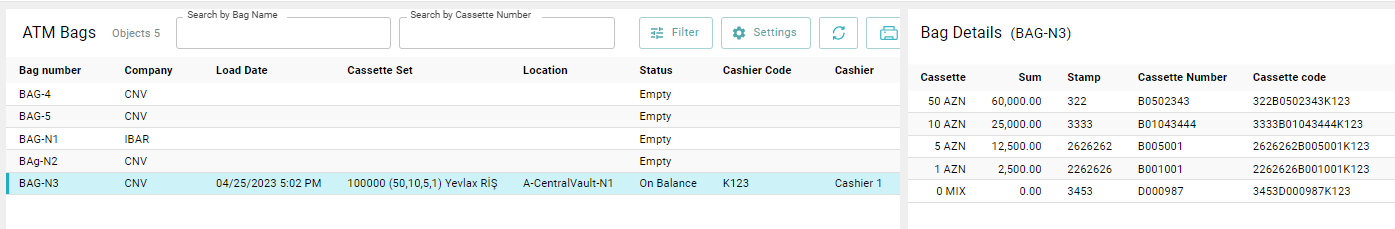

The “ATM Bags” functionality registers cash bags formed from cassette sets, with detailed accounting data recorded for each cassette within the bag. Prepared bags are assigned to loading into ATMs and tracked throughout the entire cash-in-transit cycle.

This functionality has been successfully utilized by a prominent Azerbaijani bank with the country’s largest ATM network for over a year. Thanks to the implementation of updates, the financial institution has effectively automated tasks related to managing cash logistics during the loading of cash into bags and cassettes for cash-in-transit operations.

The number of errors in cash counting at the vault’s cassette balance has decreased

Commercial banks engaged in cash preparation for ATM loading typically pre-fill cash cassettes and bags in advance, store them in the vault, and hand them over to cash-in-transit personnel the next day.

Typical situation at bank #1

Picture a bustling evening at the bank, where tellers are preparing cash for loading into the ATM. Among them is Diana, a senior cashier with 15 years of experience. She diligently fills each cassette, double-checks the amounts, and seals the bags before placing them in the vault.

However, the rush in the evening sometimes leads to inadvertent mistakes. Unfortunately, on one busy day, Diana mistakenly wrote the wrong vault address in the cash flow order, specifying a local one instead of the central vault where the cassettes should have been placed. As a result, the next day, these bags with cassettes didn’t reach the ATMs, as the cash-in-transit service collected bags from the central vault as per schedule.

At the same time, the bank had to redirect cash-filled bags from one vault to another and conduct an internal investigation. This confusion affected logistics and financial reporting, causing delays for the staff and making it difficult to track cash movements.

The implementation of the new “ATM Bags” and “ATM Cassettes” functionality allows for automating the recording of loaded cash in an electronic format and ensures full control over the balance of each storage unit. The responsible cashier only needs to input the necessary data into the system, and the cash cassettes will be automatically accounted for in the corresponding bags and vaults.

For each vault the system preserves and displays the following information:

- Beginning-of-day balance of cash and valuables

- Total balance, taking into account the cash held in cassettes and bags

- Changes in balance due to incoming and outgoing operations

- End-of-day balance of cash and valuables

The process of loading cash into cash cassettes and bags has become accessible to all participants

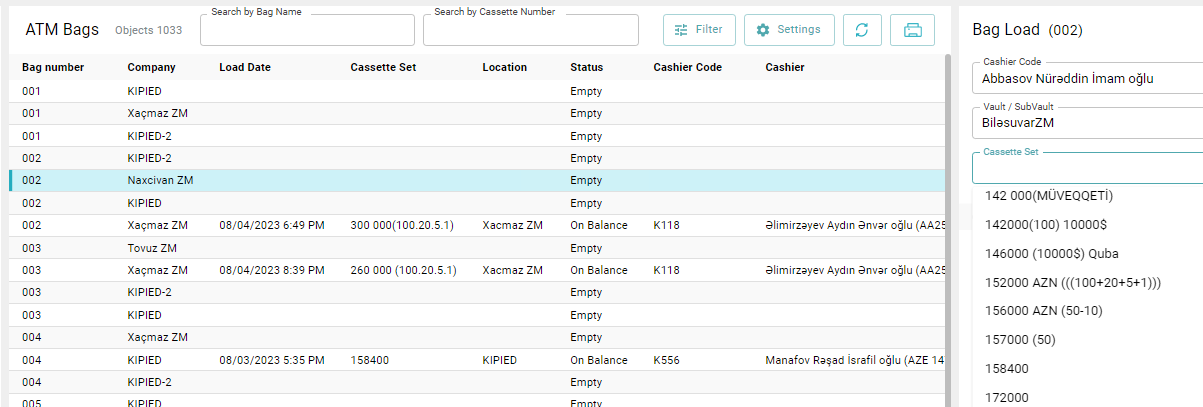

The automated cash accounting system for cash cassettes and bags, integrated into the “ATM Cassettes” and “ATM Bags” vault balances, allows for centralized and simultaneous data access. Access levels depend on the employees’ authority and responsibilities.

Typical situation at bank #2

The bank’s accountants noticed a discrepancy in the cash holdings within the vaults. Upon investigation, they identified an error in the manual recording of cash bags during the cash-in-transit process.

To identify the source of the error and rectify it, specialists conducted a thorough review of the accounting files to determine if there were accurate records of cash cassette and bag loading in each vault. They cross-referenced this information with the planned cash balance for each bag and vault and recalculated the number of bags. Subsequently, they reached out to senior cashiers and cash-in-transit teams to ascertain which cassettes were loaded into the ATMs and from which vault.

Based on the gathered information, the accountants identified an incorrect vault address mentioned in the cash-in-transit order. They made the necessary corrections to the documents and contacted the cash-in-transit service to return the cassettes from one ATM and load them into another. The entire process consumed a total of 18 working hours, involving 10 bank employees.

If the functionality of “ATM Cassettes” and “ATM Bags” were installed in the bank where Diana (from the example above) works, the specialist would have noticed her mistake herself and corrected it in a timely manner.

There is no longer a shortage or surplus of cash: funds are efficiently distributed across locations for storage and dispensing

When accounting is managed through a standard electronic spreadsheet program, the issue of centralized data access arises, hindering synchronization and information exchange among employees, especially when they work remotely or in different departments.

Typical situation at bank #3

Returning from his shift, the electrician Robert wanted to treat his seven-year-old daughter to ice cream sold at a stand along the way. The treat was only available in cash, and Robert had only his card with him. He hoped to withdraw money from the nearest ATM close to home, but it was not there. This situation has happened for the third time already.

Disheartened, Robert decided to use another bank’s ATM, conveniently located near his office. This time, he was lucky and successfully withdrew the necessary amount to buy the treat. As a result of this incident, Robert resolved not to rely on the services of the previous bank anymore and instead turned to the other one, whose service proved to be more reliable.

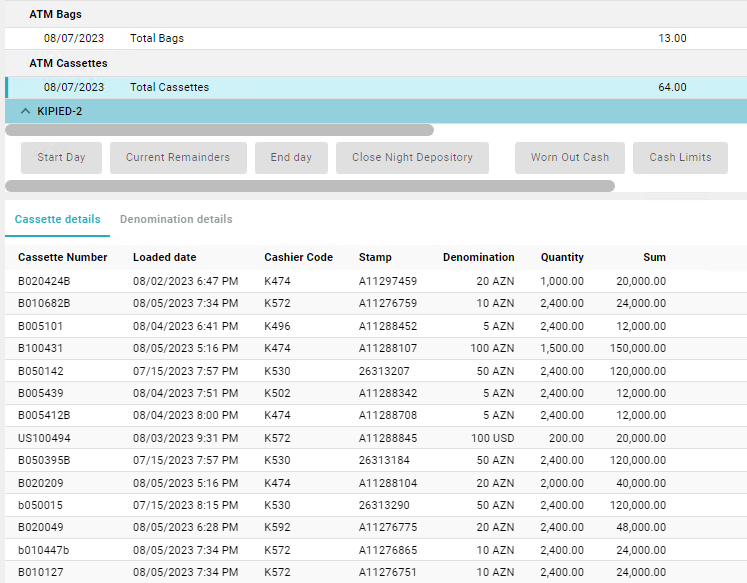

The “ATM Cassettes” and “ATM Bags” features enable bank employees to view real-time, precise data on cash reserves in the cash cassettes and bags stored in the vaults.

Instead of cumbersome files, there is a simple and user-friendly tool

Managing the balance of cash cassettes and bags in an electronic spreadsheet, such as Excel, presents additional complexities along with data input errors and limited information access. Financial specialists must manually update data for each cash collection operation, resulting in time-consuming processes and delays in balance control.

Moreover, e-spreadsheets are vulnerable from a data security perspective. Unauthorized access, file deletion, or corruption can lead to the loss or leakage of confidential information, posing additional challenges for data recovery.

Standard electronic spreadsheets provide basic tools for analytics. Manual report generation consumes staff time and relies on the competence and logical deductions of specialists, affecting the accuracy of the results. As data volume increases, managing information in such files becomes even more challenging.

Not every expert is proficient in handling the same Excel tasks. Constant employee training is required. Sometimes banks become reliant on the competencies of staff who possess knowledge of the process and expertise in report formatting within the bank.

Typical situation at bank #4

In a universal commercial bank, an experienced cashier named Alex worked diligently. He served clients for 8 years and managed cash flow records. Thanks to his Excel skills, Alex efficiently handled tasks related to monitoring the balance of ATM bags and cassettes.

During Alex’s vacation, his duties were temporarily taken over by his young and energetic colleague, Olivia. Her task was to update the data in the table with the balances of cash cassettes and bags to ensure timely replenishment of ATMs with cash. In the hustle and excitement of the new experience, Olivia accidentally swapped the columns for bags and cassettes.

The next morning, cashiers started refilling cassettes based on the data in the Excel table, completely unaware of the error. Clients came to withdraw money from their cards after receiving their salaries, only to discover that ATMs couldn’t dispense the requested amounts. Some clients became upset and demanded explanations.

When Alex returned from vacation, he discovered that incorrect data had been entered into the table. He had to meticulously check all 20 cash bags with cassettes to input accurate information. This process took over eight hours, and Alex had to stay at work until late in the evening.

The functionality is highly customizable to align with the bank’s business processes (roles and access levels, storage names, cash-in-transit team designations, etc.). With an intuitive interface and straightforward technical documentation, any staff member can easily operate the tool.

Accompanying documents can be generated with just a few clicks and printed, eliminating the need for rewriting in the case of paper stains or typographical errors in the cash-in-transit team member’s name. Electronic records are stored for historical purposes, facilitating the preparation of analytical reports.

Summary: 5 cash management questions addressed by the “ATM Cassettes” and “ATM Bags” functionality during cash-in-transit operations

The implementation of the new Cash Management.iQ software functionality — “ATM Cassettes” and “ATM Bags” and options for controlling cash advances to cashiers — significantly enhances the process of cash tracking cassettes and bags in the bank’s vaults.

This functionality allows for:

1. Implement automated cash reconciliation with the ability to track cash inventory in ATM cassettes and bags

2. Enable the capability to place orders for ATM cash replenishment using pre-prepared cash bags and cassettes

3. Generate accompanying documents and reports seamlessly

4. Mitigate potential cash surplus and shortage risks in cash storage and dispensing locations