Each financial institution chooses its own methods to manage cash flows effectively. Some invest in their own IT-teams and make software products that are most tailored to specific requirements. Others turn to third-party developers and integrators to implement solutions that have already proven themselves on the market.

When contacting a third-party company, credit organizations, especially small ones, are faced with the question whether to acquire cash management systems or simply use the functionality of a selected product.

Perhaps, there can be no universal solution to this issue. However, in recent years, Cash Management Software-as-a-Service (rent of specialized software) is gaining popularity among banks and collection services. This happens for a number of reasons.

Expense management

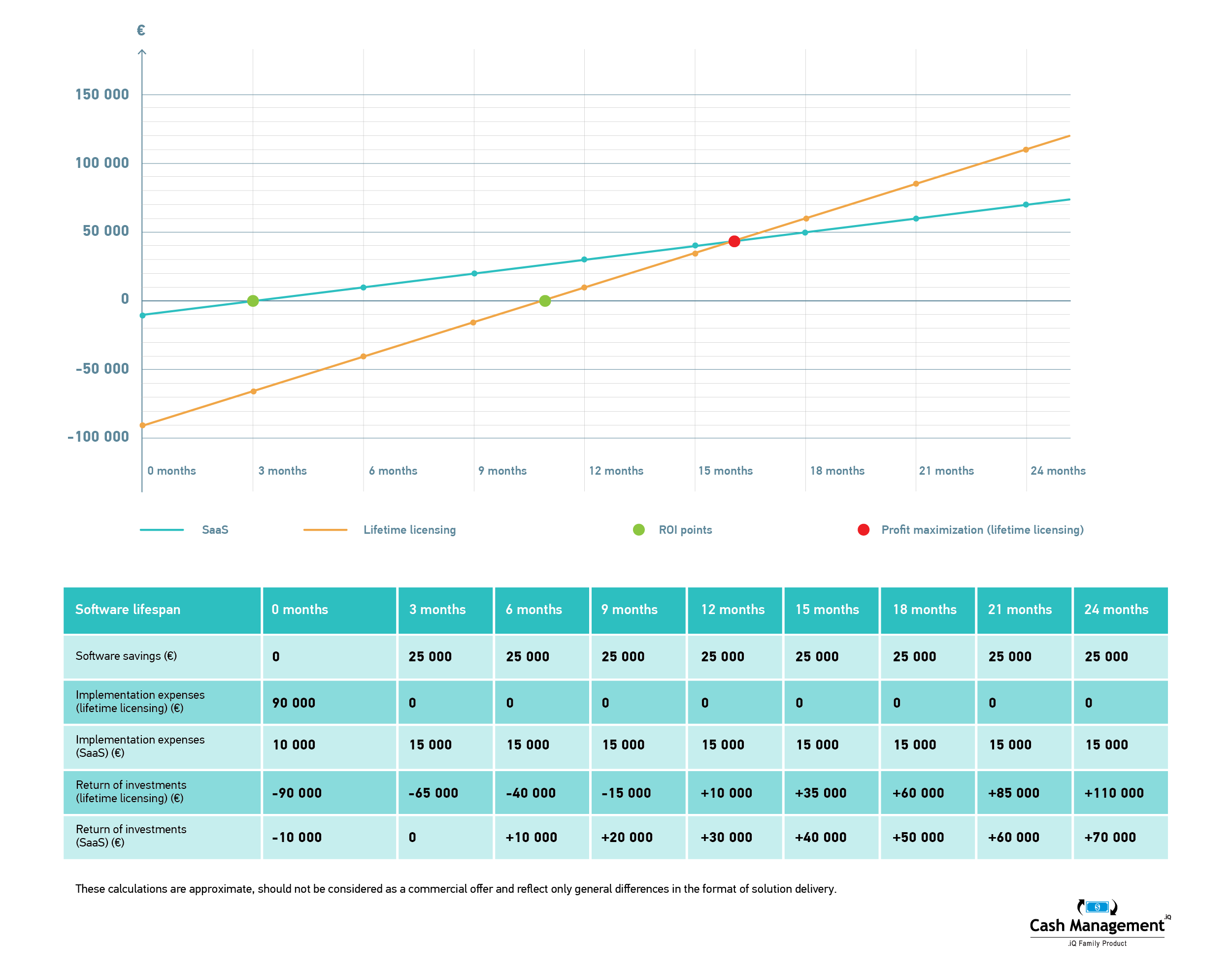

The key feature of Cash Management Software-as-a-Service is the ability to more effectively manage its investments in upgrading its technical infrastructure. Buying perpetual licenses imposes significant financial obligations on the bank and can significantly delay the decision-making process.

Small and medium-sized banks and credit unions often avoid implementing technological solutions that reduce expenses and increase efficiency because of the high cost of cash management solutions.

Purchasing software licenses under the SaaS model in this sense makes it easier, since product costs are broken down into recurring payments. In turn, the launch of the project ceases to be associated with significant investments. Furthermore, the SaaS model implies a better control over the risks associated with these investments, as in case of unsatisfactory performance results it is much easier to abandon the product used.

Product updates

Physically, the main functional modules of cash management systems can be placed both on the servers of the bank itself and on the server of the solution provider. In both cases, the SaaS model ensures access to the latest version of the software product, which means the possibility of using advanced functionality and minimizing the number of software errors (bugs).

When purchasing a lifetime license, the customer is obliged to independently monitor the system version update by performing manual updates or ordering the corresponding service on the side within a separate support agreement.

How critical this factor may be for banks is an open question. However, using the example of the recent update of the Cash Management.iQ system’s forecasting mechanism, the forecast accuracy is increased by 10-20%. For a fleet of 1000 ATMs, this can mean saving hundreds of thousands of dollars a year.

In addition, each developer of such systems can enhance the product with additional functionality, improving work performance of cash centers, CIT services and bank branches. The ability to have convenient and industry-standard tools also determines the effectiveness of operational processes.

Additional functionality and support

Depending on the form of the license, the functionality of the product may also vary considerably. Traditional SaaS format provides a replicable solution with rather limited customization possibilities. This format of using software products for cash management is suitable for customers using standard procedures for estimating demand for cash and organizing collections. It is also suitable for credit organizations that are still planning to implement these procedures and are ready to use what is offered by the software developer. According to the experience of BS/2 specialists, the number of such credit organizations is very limited.

SaaS format standards imply constant customer access to technical support made possible by the solution provider. For systems of this level of complexity, this is an important factor, since the possibility of promptly eliminating failures during operation reduces the costs associated with improper loading of cash, downtime of self-service devices or other problems.

For owners of a lifetime license of cash management systems, support is provided under a separate contract that requires constant renewal. In addition, if the client uses an outdated version, the solution provider does not always have the opportunity to provide the necessary SLA when solving a problem.

Conclusion

Perhaps the purchase of software lifetime licenses in banking remains the norm. Nevertheless, many credit institutions are beginning to see SaaS as a form of operational and technological investment.

The ratification of the EU PSD2 directive, which defines and enforces the principles of open banking, also contributes to the ‘as-a-service’ solutions growing in popularity among fintech companies.

Learn more about the benefits of using cash flow management tools for your business by contacting the BS/2 company representatives today.